Direct Investments

Given our vertical integration, we can move quickly and provide certainty of execution to purchase assets directly from sellers looking for competitive pricing, straight talk and clear, transparent execution capabilities.

Incorporating cultural and social impact strategies that help build community.

Improving the environmental sustainability and utility efficiency of the physical property.

Vertical integration of institutional management best practices that optimize operational performance and ensure rigorous risk management.

Comunidad Partners creates additional value for residents in many ways, providing:

These conveniences provide residents with value that extends past their physical apartment homes, allowing Comunidad Partners’ properties to experience one of the highest resident retention rates in the country.

Whether it’s buying, developing, partnering or providing strategic capital, Comunidad is the vertically integrated capital platform that can provide certainty of execution and help drive value for you on your workforce/affordable housing assets.

Given our vertical integration, we can move quickly and provide certainty of execution to purchase assets directly from sellers looking for competitive pricing, straight talk and clear, transparent execution capabilities.

For partners wanting strategic capital, we can provide Co-GP solutions around GP investments and balance sheet support. We add value beyond just capital for sponsors with our vertical management integration, social impact and proprietary technology platform.

For workforce/affordable housing developers, we can provide GP co-investment, partnership capital and vertical integration of aligned management teams to drive maximum value to your project.

We are a mission-driven investment firm that cares deeply about community. Our in-house teams focus on creating and preserving affordable housing, social impact and environmental outcomes. We look forward to exploring your community impact needs.

Investments include equity recapitalizations, preferred equity and note purchases of workforce/affordable multifamily housing.

Contact us to be notified when Comunidad Partners assets are available for sale.

If you have an opportunity you would like to explore with us, let’s connect.

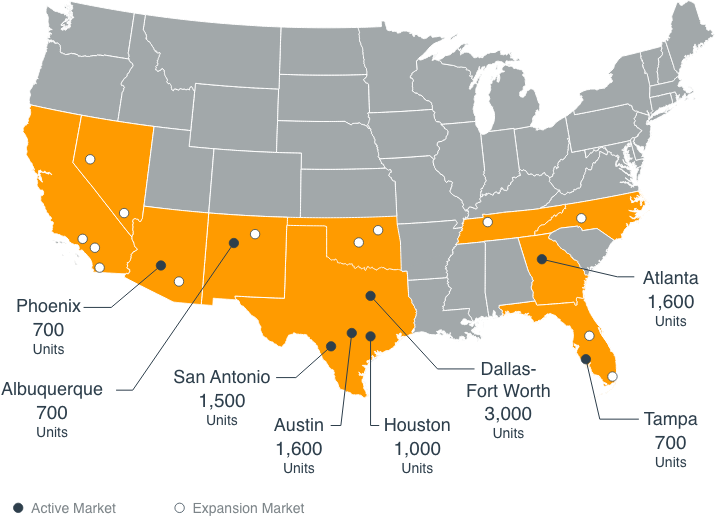

Job creation growth markets (workforce), real wage growth, population and household formation.

Near strong job centers, acclaimed schools, retail, amenities and transportation nodes/public transit.

Constrained workforce housing supply with strong demand.

Diverse demographic makeup, household pulse surveys (i.e., food security/access to health care/access to education/job status/housing stability), retail sales growth, family concentrations of 15%+ in ZIP code, high rentership rates and strong rent-to-income fundamentals.

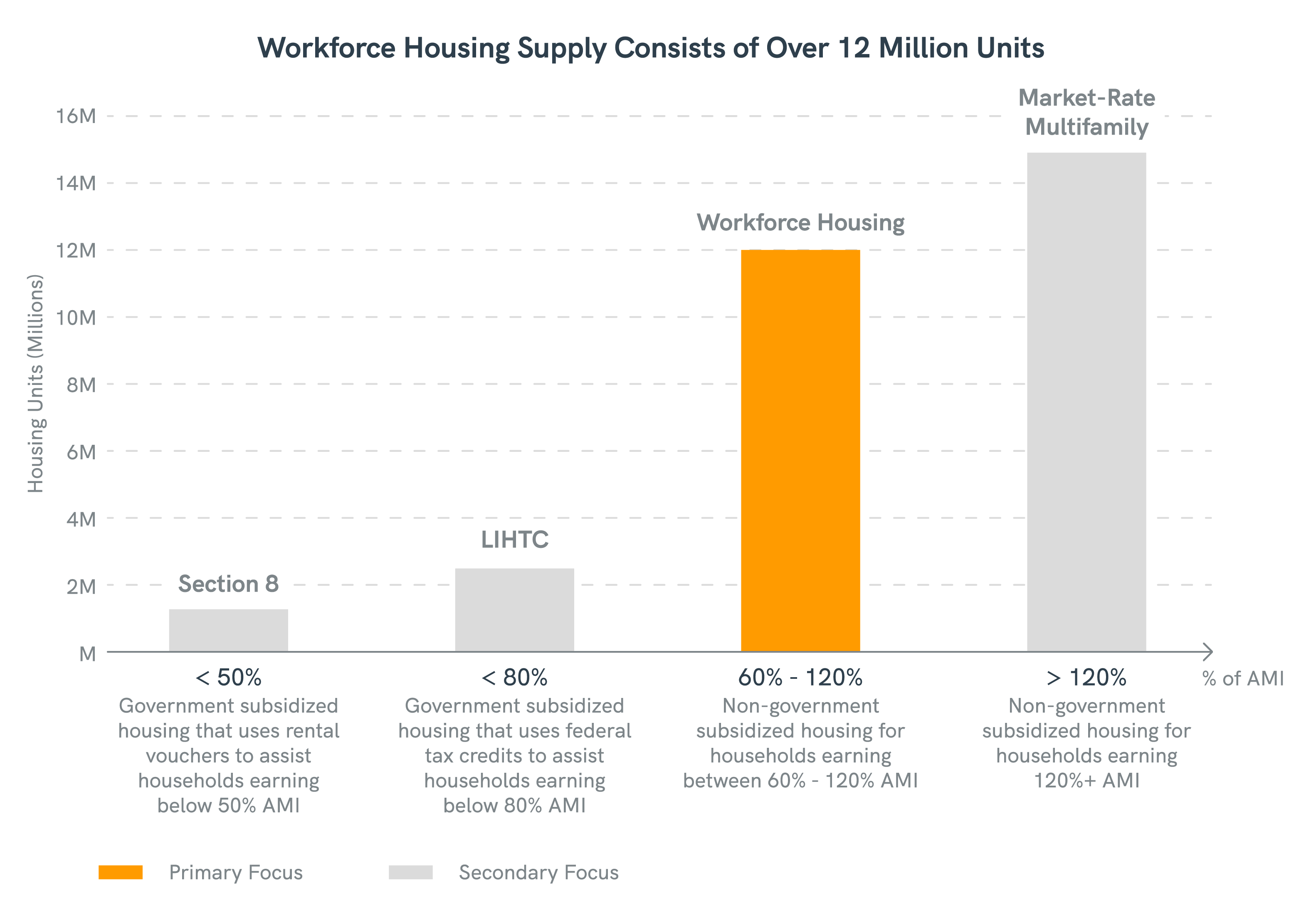

With institutional investors focused primarily on the upper segment and federal policymakers on the lower, workforce housing in the middle comprises 52% of national multifamily housing stock and has gone largely untapped by professional operators in relation to the overall market.

Positive sector and demographic tailwinds are creating investment opportunities in cultural workforce housing.

Workforce housing supply/demand imbalance and affordability concerns continue to increase.

Fragmented ownership presents opportunities to acquire undermanaged and/or mispriced assets.

The workforce housing sector is robust and geared toward renters earning between 60% – 120% of area median income. (CBRE Economic Advisors)

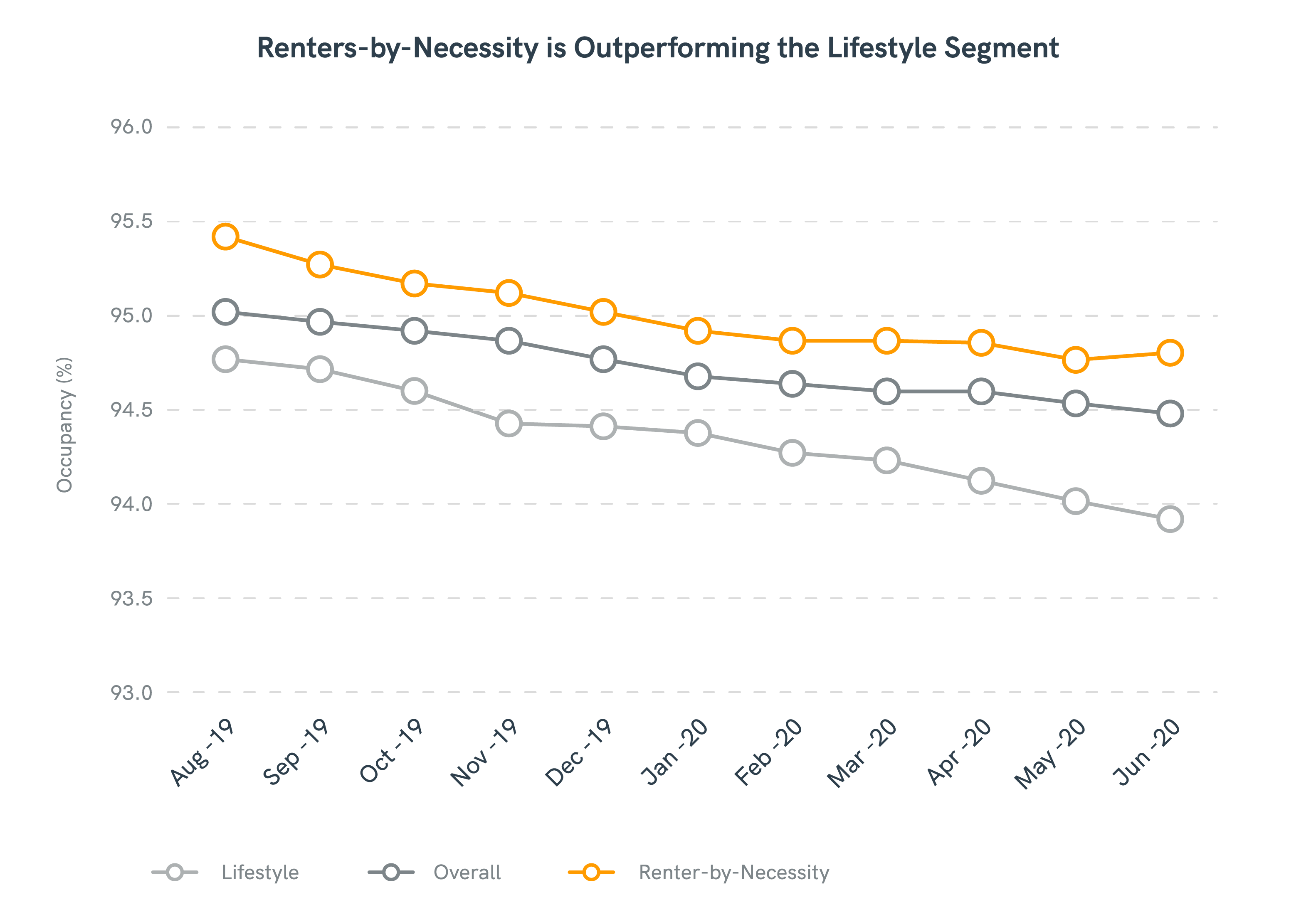

The workforce housing sector generally represents renters-by-necessity, defined as renters who are unable to afford the cost of homeownership.

This segment has outperformed the broader multifamily market, generating a collections rate of 94.3% vs. 92.1% between April–August 2020. (Yardi National Multifamily Report)

At Comunidad Partners, we leverage technology through our proprietary platform that applies data science and predictive analytics. That data creates unique insights and an innovative way to invest, operate and manage risks more effectively in order to add value to our stakeholders.

Our best-in-class platform delivers advanced insights into the performance of our assets along with market selection algorithms that enable us to source unique opportunities. Our analytical capabilities also help to demonstrate the connection between social/environmental outcomes and investment performance, aligning our social initiatives with our financial goals.

Real-time analytics and operational key performance indicators drive alpha.